In 2014, a widely publicized case showcased the high cost of a flawed background check. A rideshare driver with a serious criminal record managed to slip through a company’s basic screening process.

The result?

Passengers were put at risk, multiple assaults occurred, and the company faced lawsuits, public backlash, and millions in reputational damage. The lesson is clear: when it comes to hiring, trust alone isn’t enough; verification is essential. A standard background check may catch obvious red flags. Still, for positions of trust, such as caring for children, handling sensitive data, managing finances, or working with vulnerable individuals, employers need a deeper level of assurance.

That’s why, today, organizations face rising compliance requirements, stricter regulations, and a non-negotiable duty to protect their customers, employees, and brands. A level 2 background check is one of the most rigorous tools companies use to meet that duty, going far beyond a simple name-based screen to uncover risks others might miss.

But what exactly is a level 2 background check? How does it differ from a basic check? Who needs it, and what disqualifies you from a level 2 background?

This detailed guide will answer those questions, break down where Level 2 background screening is required, and show you how to build a stronger, fully compliant hiring strategy with Exela’s Background Verification and Compliance Solutions.

What Is a Level 2 Background Screening?

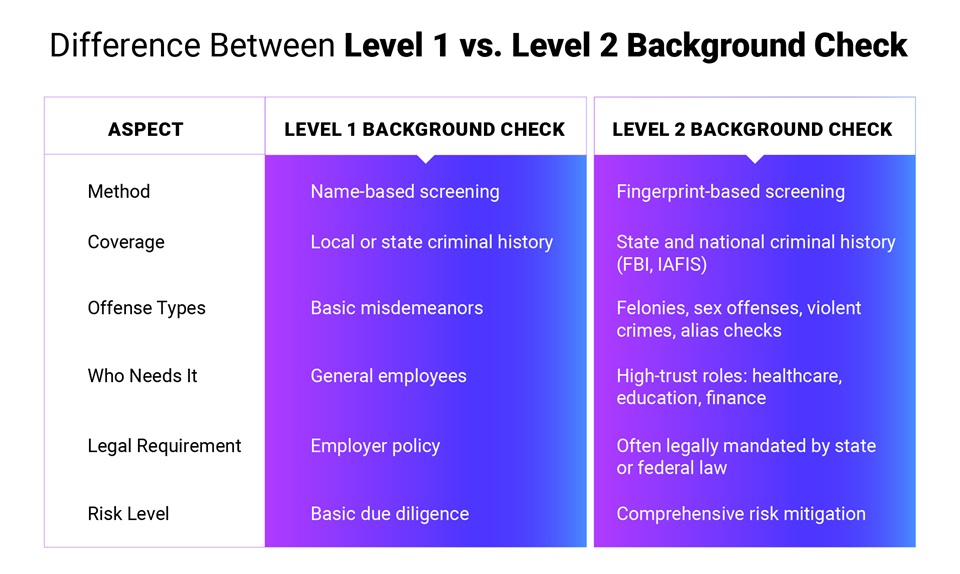

Let’s break it down: A level 2 background check is an advanced background screening that typically uses fingerprint-based searches through state and federal criminal databases.

Unlike a level 1 check, which might only verify a candidate’s identity and check for local misdemeanors, a level 2 check can reveal:

- Arrests or convictions anywhere in the U.S.

- Felony or violent crime history.

- Whether a candidate appears on sex offender registries.

- Outstanding warrants or unresolved charges.

- Alias names or other identities linked to the individual.

In Florida, for example, Level 2 checks are defined under Florida Statutes Chapter 435. They are required for employees who work with vulnerable populations, such as children, the elderly, or individuals with disabilities.

Why Is Level 2 Background Screening Critical?

Organizations have a legal and moral obligation to protect those they serve.

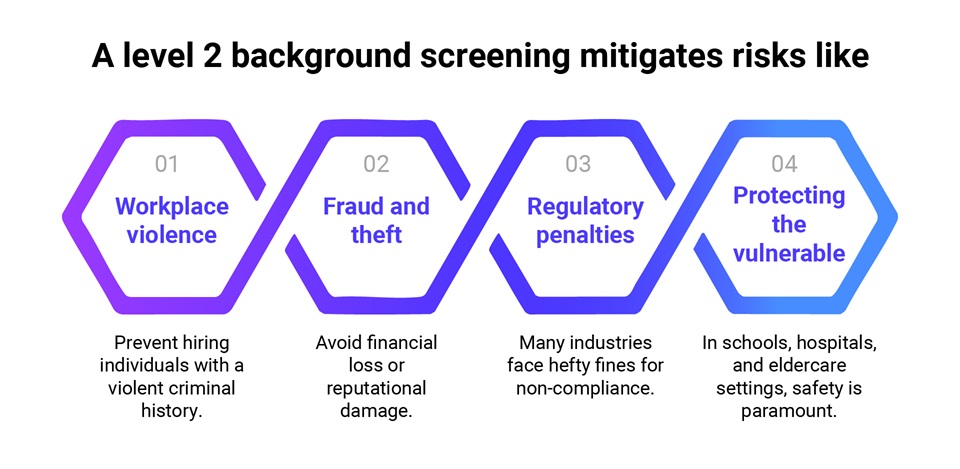

A level 2 background screening mitigates risks like:

- Workplace violence: Prevent hiring individuals with a violent criminal history.

- Fraud and theft: Avoid financial loss or reputational damage.

- Regulatory penalties: Many industries face hefty fines for non-compliance.

- Protecting the vulnerable: In schools, hospitals, and eldercare settings, safety is paramount.

The reality is, some roles require deeper trust and stricter safeguards.

According to a CareerBuilder survey, nearly 72% of employers conduct some form of background screening to protect their workplace, with deeper checks for sensitive roles (CareerBuilder)

How Does a Level 2 Background Screening Work?

Unlike a basic name-based check, a level 2 background check uses biometric data — your fingerprints — to match against multiple databases.

Here’s how it generally works:

- Consent and Fingerprinting: The candidate provides written consent and submits fingerprints through an approved vendor.

- State and Federal Database Checks: The fingerprints are run through state repositories and the FBI’s national database to uncover any record of criminal history nationwide.

- Review of Results: Employers or licensing boards review any relevant information, such as hits, arrests, charges, or convictions, to determine whether it disqualifies the applicant.

- Decision & Compliance: Final hiring decisions are made in accordance with legal guidelines, ensuring that no discrimination or wrongful denial occurs. Employers must also comply with the Fair Credit Reporting Act (FCRA) and guidelines established by the Equal Employment Opportunity Commission (EEOC).

Must read: https://ehrs.exelatech.com/blog/why-ai-background-checks-are-future-hiring

What Disqualifies You from a Level 2 Background Check?

It depends on the industry, the role, and local regulations. Generally, the following could disqualify a candidate:

- Felonies: Especially violent crimes, sex offenses, or serious theft and fraud convictions.

- Certain misdemeanors: Child abuse or domestic violence.

- Listing on sex offender registries

- Pending criminal charges: In some sectors, unresolved charges can delay or deny clearance.

- Falsification of application details: Lying about employment history or hiding criminal records can be grounds for disqualification.

It’s important to remember that disqualification is not always automatic; some offenses have look-back periods or appeal processes. Employers must carefully balance safety, rehabilitation rights, and legal obligations.

Industries Where Level 2 Background Checks Are Non-Negotiable

While level 2 background screening is common in healthcare and education, today’s complex global economy means that other sectors also rely on this advanced vetting.

Here are some key industries where a level 2 background check is a smart, often mandatory, safeguard:

Healthcare and Elder Care: Doctors, nurses, caregivers, and home health aides work with society’s most vulnerable. Patients who trust them with their well-being. Level 2 checks in healthcare ensure that individuals with a history of abuse or violent behavior aren’t placed in these sensitive roles. For example, many U.S. states require hospitals, nursing homes, and home health agencies to run level 2 checks before onboarding new staff.

Education and Childcare: Schools, daycares, tutoring centers, and youth camps are legally bound to protect minors. Many states mandate level 2 screening for teachers, substitute staff, school bus drivers, and even parent volunteers. Without it, schools could unknowingly expose children to potential harm — a liability no institution can afford.

Banking, Financial Services, and Insurance (BFSI): In the BFSI sector, trust is everything. Financial institutions handle sensitive customer data, large sums of money, and confidential transactions on a daily basis. A single employee with a hidden history of fraud or embezzlement could result in millions of dollars in losses, as well as reputational damage.

A level 2 background check enables banks, insurers, and investment firms to go beyond basic name checks, uncovering any history of financial crime, identity theft, or fraud across multiple states or even at the federal level. Many regulators require financial firms to implement stricter screening for roles with fiduciary responsibilities, client fund access, or regulatory reporting duties.

Government and Defense Contractors: Roles with national security implications, access to confidential data, or sensitive infrastructure come with significant trust requirements. Many public sector jobs and contractors are required to undergo rigorous Level 2 background checks to minimize insider threats.

Nonprofits and Social Services: Nonprofits that work with children, victims of abuse, or underprivileged communities often receive government funding, provided that all employees and volunteers undergo thorough vetting.

Automobiles & Auto Components: While less obvious, this sector often involves large global supply chains, proprietary designs, and valuable intellectual property. When hiring engineers, designers, or quality inspectors, manufacturers often use Level 2 background checks to mitigate the risks of trade secret theft, fraud, or workplace violence — especially in high-security R&D or manufacturing facilities.

What to Expect if You’re an Applicant

Many candidates worry about the level 2 background check process. Here’s what to know:

- Be transparent: Always disclose relevant past offenses when required.

- Correct mistakes: Sometimes, outdated or incorrect records may appear. If you spot an error, you have the right to dispute it.

- Understand your rights: Employers must obtain your consent before conducting a background check, and you have the right to request a copy of the report.

What If There’s a Mistake in the Report?

No background screening system is completely immune to human error, outdated records, or mismatched information — especially when dealing with large national and state databases. Sometimes, an old charge may remain on file even after it’s been dismissed or expunged. In other cases, a candidate’s name might be similar to someone else’s, causing records to get flagged incorrectly.

That’s why both employers and candidates must know their rights and responsibilities under the Fair Credit Reporting Act (FCRA). By law, every candidate has the right to:

- Request a copy of their background check report.

- Review the report in detail to spot any mistakes or outdated information.

- Dispute any errors with the screening provider and provide documentation that supports their claim.

- Receive a corrected report if the investigation confirms that information was inaccurate or should not be included.

Employers, meanwhile, must follow clear adverse action procedures if they plan to withdraw a job offer based on the results of a background check. This includes providing the candidate with notice, offering a copy of the report, and allowing them a reasonable amount of time to respond before making a final decision.

This safeguards candidates from wrongful hiring rejections and protects employers from potential legal disputes or claims of unfair hiring practices.

How Employers Can Stay Compliant

Running a level 2 background screening isn’t just about collecting fingerprints and waiting for a report. It’s about creating a compliant, fair, and defensible process that withstands scrutiny.

Best practices for employers include:

- Develop Clear Policies: Define which positions require deeper checks and outline exactly what kinds of convictions or red flags are disqualifying. Apply your policies consistently to avoid claims of bias or discrimination.

- Maintain Candidate Transparency: Always get clear, written consent before starting a background check. Be open about what information you’re checking and why. If you plan to take adverse action, follow the proper notification steps.

- Partner with a Trusted Screening Provider: Fingerprinting, national database checks, and compliance requirements can be complex to manage in-house. A reliable background screening partner ensures your process is thorough, efficient, and legally compliant.

- Stay Current with Changing Laws: Federal, state, and industry regulations are subject to frequent changes. A reputable screening partner will help you monitor changes and update your policies and processes accordingly.

By following these steps, you can establish a comprehensive background screening process that safeguards your workforce, customers, and brand reputation — without incurring costly legal liabilities.

Why Choose Exela HR Solutions for Level 2 Background Checks

When trust, compliance, and security matter most, you need more than a basic screening. Level 2 background checks involve biometric data, multiple databases, and strict regulatory oversight, which is why partnering with an experienced, credible provider makes all the difference.

At Exela HR Solutions (EHRS), we provide comprehensive Background Verification and Compliance Services that enable organizations of all sizes to hire confidently and responsibly.

With EHRS, you benefit from:

- Conduct background checks in 150+ countries, with advanced screening capabilities.

- Secure biometric processing, protecting candidate data at every step.

- AI-powered, fast, reliable turnaround times, so your hiring stays on schedule.

- Full compliance with all relevant state, federal, and industry requirements — minimizing risk and ensuring peace of mind.

- A positive candidate experience, with clear communication, transparent reporting, and robust support for resolving disputes if they arise.

Whether you’re hiring for healthcare, BFSI, BPS, IT, manufacturing, or any other high-trust industry, EHRS helps you build a screening process that is thorough, fair, and future-ready.

Learn more about our Background Verification and Compliance services.