This Payroll Outsourcing Company Saved 49% in Costs

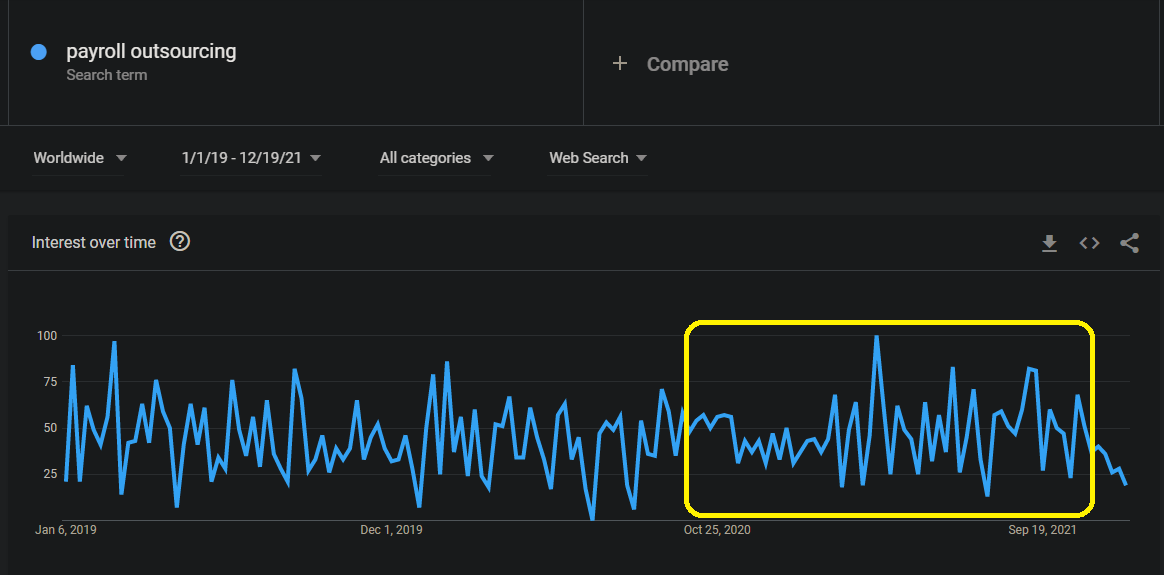

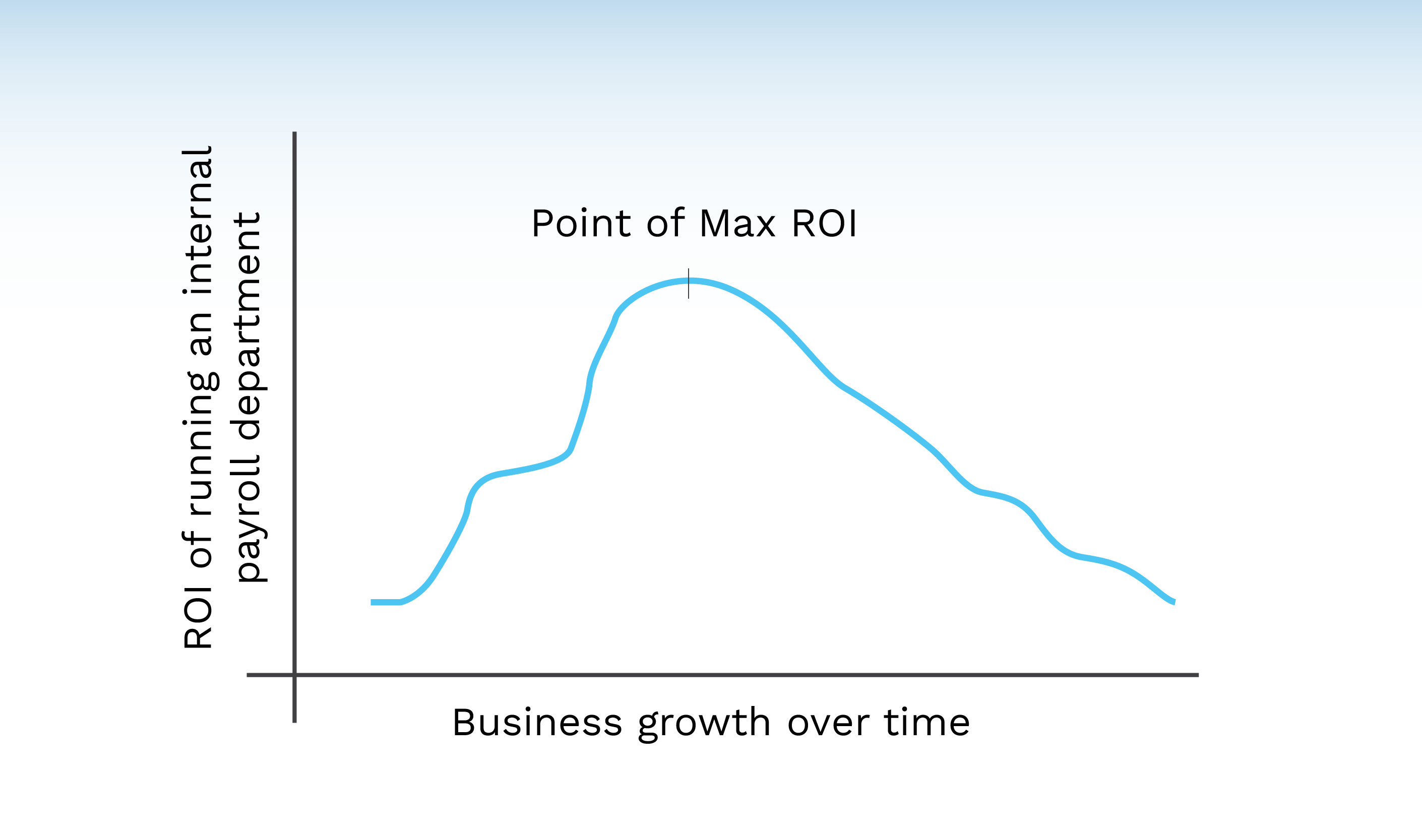

Many modern businesses, especially after the pandemic, have had a chaotic payroll function in their business. They have been forced to spend a lot of capital and resources to maintain this function of their business, but the return on investment has often been close to nothing. It’s like running on the treadmill at a fairly high speed – you can run comfortably for a few minutes but after a certain point, it is challenging to keep going at the same pace. Businesses grow, growth adds people, and people add complexities to payroll – this is a simple, conclusive truth. Businesses that can afford to keep burning valuable resources can keep doing it only for so long before the “law of diminishing returns” kicks in.

Eventually, this unseen phenomenon starts eating into the profit margin of the business which results in either one of the three outcomes.

- Severe budget cuts in other important departments of the business

- Declaring bankruptcy

- Outsourcing payroll to third party companies

Smart businesses choose the third option. Even smarter businesses choose the third option long before entering a situation where they are forced to choose it.

Big Benefits Modern Businesses Enjoy After Outsourcing Payroll to 3rd Party Companies

- Positive Opportunity Cost:

This is one of the biggest benefits that businesses experience after choosing a global payroll processing and outsourcing company. All costs related to running a payroll department internally become available to the company that can then be redeployed further into the revenue-generating departments of the business. Departments like research and development, marketing, sales, customer service, etc., where the return on investment is extremely high that actually helps contribute to the growth of the business.

- Perfect Compliance:

Global payroll processing and outsourcing companies have a team of expert lawyers, compliance officers, and auditors to make sure you adhere to even the tiniest compliance law there is out there. With guidelines changing so frequently nowadays, it becomes tough for HR generalists, who are usually involved in processing payroll, to keep up with these changing compliance laws and guidelines. Moreover, if your business gets caught not complying, regulatory authorities impose hefty fines for such infractions, even if it was an honest mistake. For most businesses, paying just one or two such fines can cause months or even years of a setback in their progress – possibly a shutdown.

- Data Security:

Payroll data is amongst the most sensitive data a company can hold. Therefore, the protection of this data is vital. According to a recent study by RedTeam Security, 56% of all payroll data breach incidents occurred due to internal employees who had unrestricted access to this sensitive data. Global payroll processing and outsourcing companies invest heavily in this area to build the necessary technological infrastructure to store and manage such data. However, investing this heavily in a low-ROI arm of the business is not feasible for most businesses, making it even more attractive to get the best security there is for your data, at a fraction of the cost. Next time you’re in the market for global or local payroll processing, make sure you ask these questions to your payroll outsourcing company:

- Any accreditations your infrastructure and processes are compliant with?

- Any locations where data is hosted?

- Who has permissionless authority to access our data?

- How does data backup occur?

- How is the data stored on your servers and transmitted to us?

- Any on-site security measures where the servers are kept?

- Any antivirus/firewalls used to defend against real-time attacks?

- Any protocols, in the unlikely event of a breach?

Also read: Payroll Trends to Keep You Ahead of the Curve in 2022

Highly Improved Payroll Processing Timelines Globally

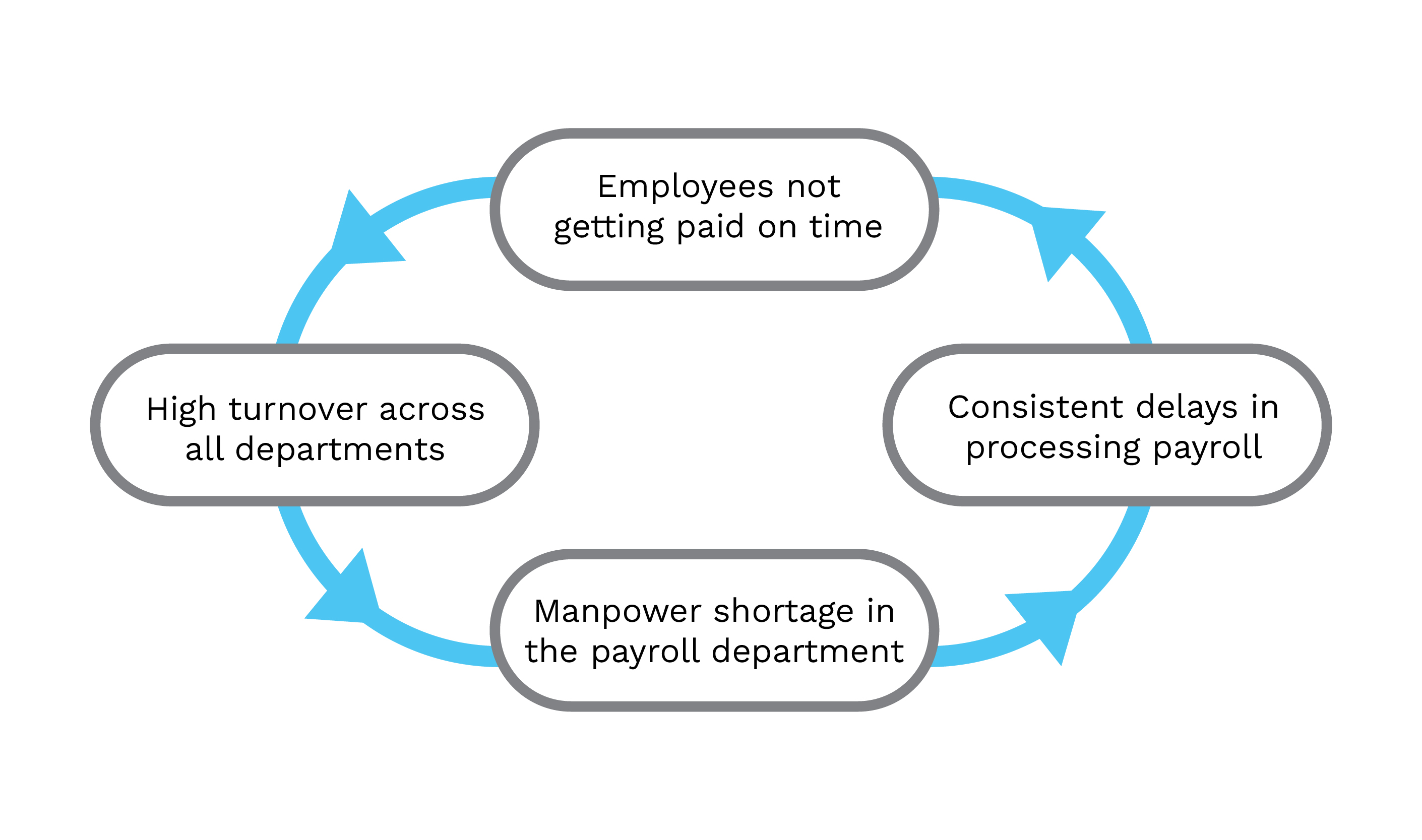

From the employee’s perspective, the biggest demotivating experience they can have while working for an employer is not getting paid on time. This gives birth to a vicious circle and increases turnover significantly – another added cost.

Global payroll processing and outsourcing companies never have this problem because of two big reasons:

- Robust technological infrastructure to process high volumes of payroll that is maintained extremely meticulously.

- Almost all the payroll sub-functions are fully or partially automated using varying degrees of robotic process automation.

Therefore, businesses that choose to outsource their payroll to a different company get to experience world-class service without ever having to spend a dime on building the tech in-house from scratch.

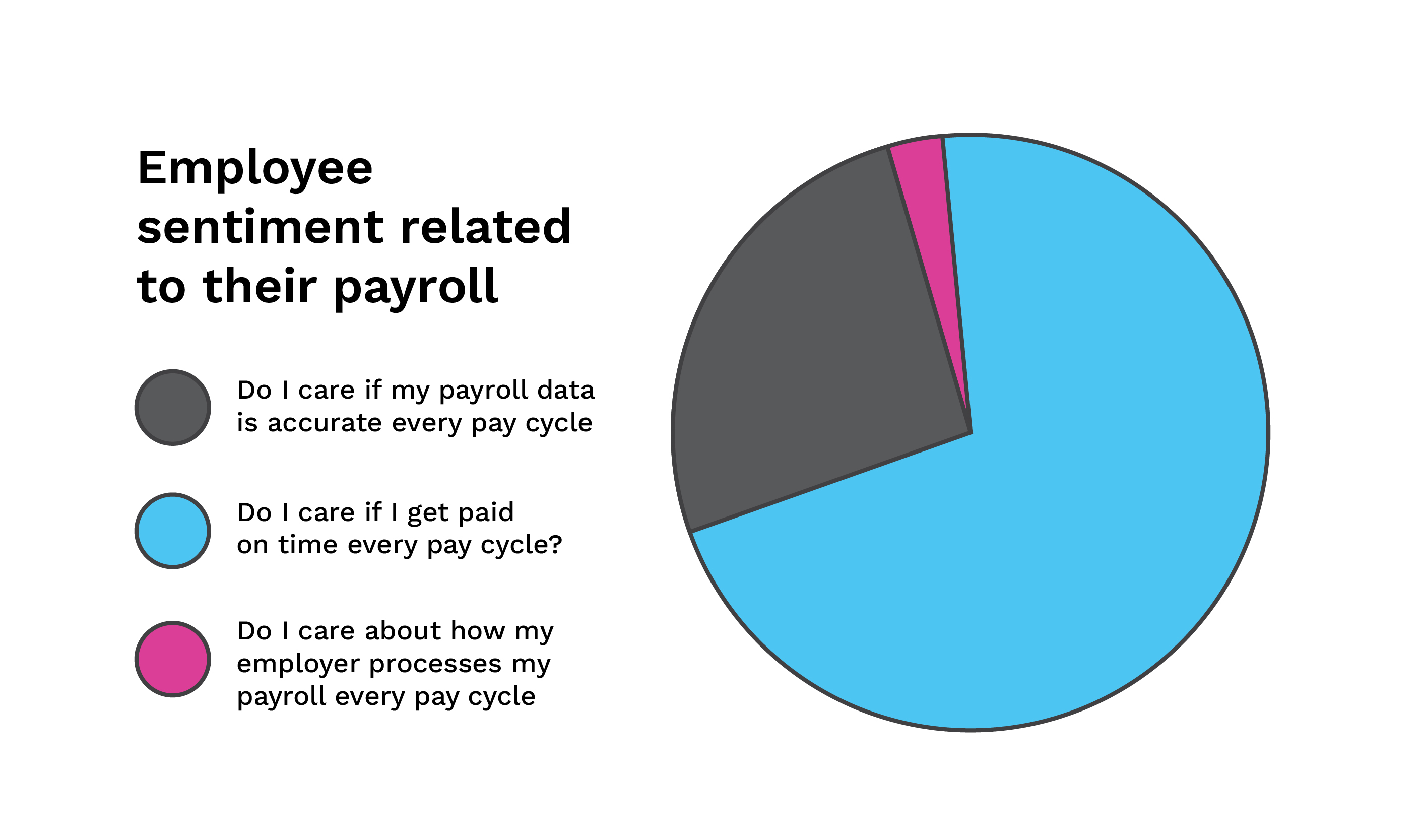

Accuracy and Employee Satisfaction

The last group of people who are going to be affected by how your business does payroll is your employees. Their feedback will matter the most when deciding whether or not your payroll system works. Here’s why.

Accuracy and timely pay have a direct correlation with employee satisfaction. As long as you, as an employer, are able to get these two things right consistently month-over-month or week-over-week, your employees will not care how you get it done.

Tax season has always been the biggest test of a payroll system. Sit back and truly reflect for a few minutes on how your payroll team has been performing for the last few tax seasons. Do they get overwhelmed? Are they short-staffed? Were you always nervous about needing to call in reinforcements (freelancers/contract workers) at any time? How was the reaction post-tax season? Were there too many employees complaining about inaccurate filings, deductions, or calculations immediately after tax season? Did your staff size grow over the last few years? How has that affected the payroll system during the tax season?

If the answers to those questions do not look satisfying to you, it is time you try something new: global payroll processing and outsourcing companies.

49% Off After Choosing a Global Payroll Processing & Outsourcing Company?

In 2007, John Keegan, who was the sales and marketing director of Capita at the time, gave invaluable insight on payroll and his perspective on the matter that was derived from years of raw experience.

He gave an example of one of his clients that pulled down their overhead costs by a whopping 49% in just 4 years by outsourcing all of their payroll activities. He further added, “This firm had 10,000 employees, four different payroll departments, and used three different pieces of software. If we hadn’t saved them upwards of 30%, I’d have been disappointed.”

Even for a big global payroll processing and outsourcing company, this level of reduction in overhead was completely unheard of at that time. Addressing other business owners that did not have thousands of employees on their payroll, he had something else to say.

“95% of firms outsource because they believe it will save them money. Although true, sometimes it takes the benefits a bit longer to reach your business. Businesses may never see a single dollar in cost savings until 18 months after outsourcing their payroll to global processing companies. It is almost never possible that your business will see cost savings from day one unless your payroll system was run extremely inefficiently prior to choosing payroll providers. It is fairly safe to say that employers can start to expect saving an average of 20% per year after an initial period of seven years.”

Recap and Conclusion:

- As the business grows with time, your ability to extract returns from your in-house payroll system starts to fall rapidly – the law of diminishing returns.

- There are huge benefits to outsourcing your payroll.

- Huge Benefit #1: Positive opportunity cost – you’d rather spend your valuable time and resources on revenue-generating arms of your business.

- Huge Benefit #2: Perfect compliance – you always stay on the right side of the law and avoid hefty fines.

- Huge Benefit #3: Data security – you get access to a powerful technological payroll infrastructure that keeps all your sensitive data safe.

- Huge Benefit #4: Employees get paid on time – you leverage today’s bleeding-edge tech like robotic process automation to get the best experience for your employees.

- Huge Benefit #5: Accuracy and employee satisfaction – tax season, the greatest predictor of a sturdy payroll system. No complaints from employees after tax season = great payroll execution.

- A bigger employee size in a company automatically translates to greater reductions in overhead costs related to payroll.

- Although, even small to medium businesses that do not have thousands of employees can benefit from choosing to partner with global payroll processing and outsourcing companies by saving an average of 20% per year.

Exela HR Solutions offers world-class payroll solutions to businesses of all sizes across different industries and geographies. We have contributed successfully to the growth strategies of multiple businesses over the course of the last few years. Our team of payroll experts comprises lawyers, compliance experts, auditors, and experienced payroll specialists that act as one cohesive unit to cater to your payroll needs 24/7.

Get on a short call with us today to learn more about our offerings.

Sources: google.com | en.wikipedia.org | reddit.com | completepayrollsolutions.com | employeebenefits.co.uk

DISCLAIMER: The information on this site is for general information purposes only and is not intended to serve as legal advice. Laws governing the subject matter may change quickly and Exela cannot guarantee that all the information on this site is current or correct. Should you have specific legal questions about any of the information on this site, you should consult with a licensed attorney in your area.